- Personal

Personal Banking

PERSONAL LOANS & CREDIT

RETIREMENT & INVESTMENTS

Digital Banking

- Business

Business Banking

BUSINESS LOANS & CREDIT

Business Services

Digital Banking

- Commercial

Commercial Banking

Commercial Loans & Financing

Treasury Management

Additional Commercial Solutions

- Wealth

Private Wealth Management

Institutional Asset Management

Investments

Corporate Underwriting

- About Us

Community Involvement

Company

Our Insights Blog

Our Team

Tackle your business needs with Interest Business Checking

A smart checking option for businesses with higher account balances that can earn interest at a competitive rate.

The features and benefits of an Interest Business Checking account

Overdraft Protection

Ability to add overdraft protection through a Business Line of Credit or savings account2Services you need

Up to 500 monthly transactions3 and up to$20,000 in monthly cash deposots4Business Debit Cards

Visa® Debit Card with chip technology and higher limitsDirect Deposits

Send direct deposit to employees securely, on time and directly into their accounts6

Integration Convenience

Interface with software like Quicken® and QuickBooks® and grant varying levels of access to key users – even your CPA – and closely monitor account activityThe features and benefits of an Interest Business Checking account

Send direct deposit to employees securely, on time and directly into their accounts6

After the first month, you can waive the $25 monthly service change with any of these options:

-

Keep a $25,000 minimum daily balance, or

-

Maintain a combined balance of $50,000 or more in loans and deposits, excluding your personal accounts5, or

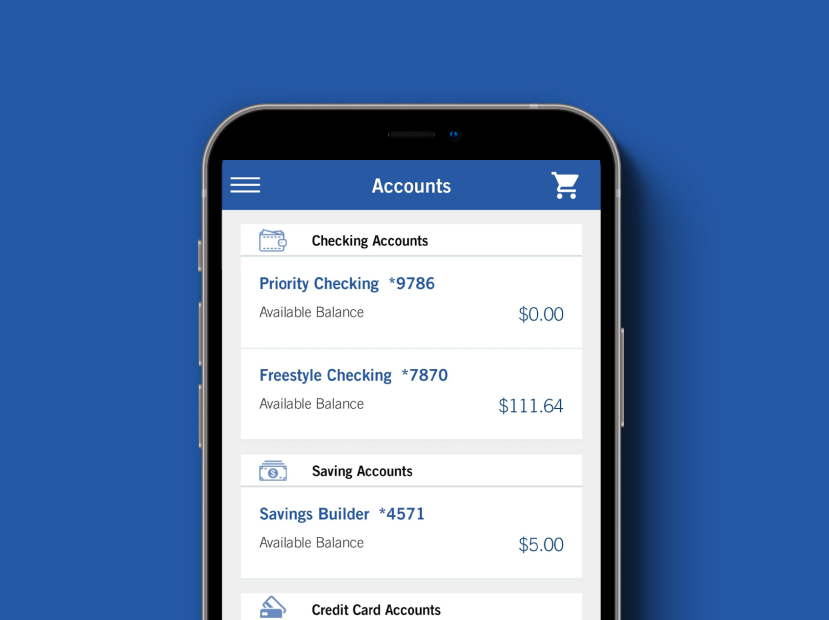

Take your Interest Business Checking account on the go with our mobile app

Mobile Check Deposit

Deposit checks and view deposit history with just a few taps.

Transfer Funds

Easily transfer money between your accounts - even those at other financial institutions. Transfers can be made immediately or scheduled for future dates.

Bill Pay

Pay your bills anytime, anywhere with the touch of a finger. Schedule payments, add payees and more.

Scale your business with Merchant Services

Pair with Merchant Services7 for next-day cash funding to help keep your business running smoothly, no matter what the day throws your way.

Not sure if this account is right for your business?

Our side-by-side comparison will help you sort through the details.1 There is a $50 minimum deposit to open account. A $20 fee applies if account is closed within 360 days of opening account.

2 There is a $10 transfer fee for this service.

3 After 500 transactions a fee of $.50 for each transaction over 500 applies.

4 If account exceeds $20,000 in cash deposits in a month, a charge of $0.25 per $100 in cash deposits will apply

5 Combined balance includes combination of deposits, loans, lines of credit balances, and includes consumer accounts. Excludes Certificates of Deposit.

6 Direct Deposit Services can be accessed through Business Online Banking. Direct Deposit Service fee is $9.95/month.

7Additional fees apply for this service.

Apple is a trademark of Apple Inc., registered in the U.S. and other countries. Apple Pay is a trademark of Apple, Inc. Google Pay and Chrome are trademarks of Google, Inc. Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co., Ltd.

QuickBooks and Quicken are registered trademarks of Intuit, Inc.

Proud to be an official sponsor of

Hancock Whitney Bank, Member FDIC and ![]() Equal Housing Lender. All loans and accounts subject to credit approval. Terms and conditions apply.

Equal Housing Lender. All loans and accounts subject to credit approval. Terms and conditions apply.

Hancock Whitney and the Hancock Whitney logo are federally-registered trademarks of Hancock Whitney Corporation. © Hancock Whitney 2024

![]()