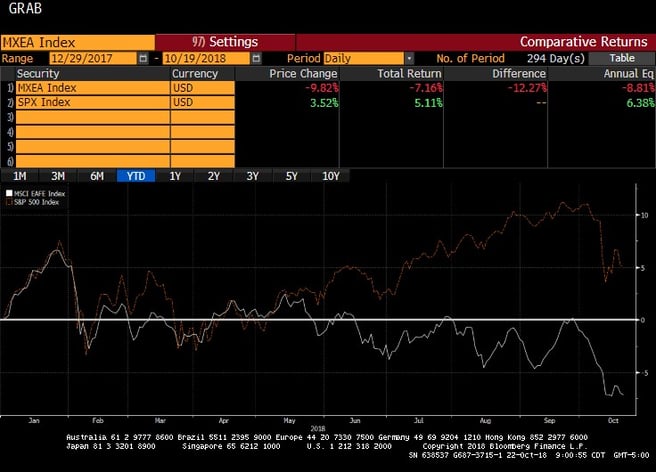

In 2018, we’ve seen an unprecedented divergence between U.S. equities and those from international markets, including those represented by the Europe, Asia, Far East Index (EAFE) and Emerging Markets. What’s causing the disparity — and what does it mean for your portfolio? Let’s take a look.

An Overview of Divergence Catalysts

A combination of factors allowed the S&P 500 index to deliver superior growth compared to international stocks. First, strong GDP growth, exemplified by 3.5% growth in Q3, fueled by 24.9% EPS growth and 8.5% revenue growth for S&P 500 companies, according to Factset. In addition, stock buybacks made possible by the repatriation provisions of the 2017 tax cut legislation increased 60% in Q2, further boosting U.S. equity market performance.

On the international front, several headwinds continued to hamper equity markets. European Purchasing Manager Indexes (PMIs) continued to trend lower, though remaining in expansionary mode. Brexit talks were not able to progress, fueling worries that a “hard” Brexit is an increasingly likely outcome, which would have negative economic impacts. In addition, populism showed its continued presence with the budget disputes in Italy, threatening the EU’s ability to enforce its fiscal rules on member nations.

Source: Bloomberg

Factors Favoring U.S. Markets

Given the unusually large performance gap, exceeding 1200 basis points (see Chart 1, above), between U.S. and non-U.S. stocks this year, should we expect a reversal or more of the same pattern? There are a number of factors we can identify that may impact the outcome.

These factors tend to favor U.S. stocks over the rest of the globe:

- The S&P 500 is expected to produce year-over-year earnings growth of approximately 20% over the next few quarters*. If so, this will support continued relative strength in the U.S. stock indices.

- The U.S. has gained economic momentum since the passage of the tax cuts in December 2017. The rest of the world has seen growth diminish. In fact, the share of global PMIs by country that rose in the latest monthly report was only 38%. Continuation of this trend favors U.S. stocks.

- Trade tensions have been more harmful to other nations’ stock markets than to U.S. markets. Relative to the rest of the world, the U.S. is less dependent on exports because it has the largest consumer market in the world. Should trade tensions escalate further, global growth may suffer, but the U.S. is likely to see less impact economically and U.S. markets should continue to fare better in comparison to other markets.

- Should the Emerging Markets turbulence spread to developed markets, the U.S. would be in a more favorable position to weather the shift. Europe’s exports to the EM represent almost 10% of its GDP, while such exports are less than 4% of the U.S. GDP.

- The U.K. and the EU have struggled to find agreeable terms on which to settle Brexit. In addition, the EU faces a difficult problem in enforcing its deficit spending rules upon Italy, who has been refusing to honor them. Italy’s bond market is the world’s fourth largest, and the EU can ill afford to bail it out. An escalation of such issues favors the U.S. equity markets.

Factors Favoring Foreign Markets

All of that said, there are also some factors that could flip market momentum in favor of non-U.S. stocks:

- Over the coming year, the strong earnings growth of U.S. companies will likely decline as the effect of U.S. tax cuts fades due to more difficult comparisons with prior-year results. Thus, a convergence of earnings growth rates with other regions of the world is likely.

- The double-digit performance gap between U.S. and foreign markets is unusual. Before the correction that is underway at this writing, U.S. companies appeared to be overbought and only in need of a catalyst, such as declining earnings growth, for the gap to close.

- The valuation of non-U.S. markets is compelling. The MSCI All Country ex-U.S. World Index (ACWI ex US) currently exhibits Price/Earnings, Price/Book Value and Price/Cash Flow ratios of 15.6, 1.7 and 9.3, respectively. The MSCI ACWI US, which covers only the U.S. market, shows values for these ratios of 22.8, 3.5 and 14.8, respectively. Valuation gaps can last for long periods of time, but they eventually narrow or close.

- Should the Federal Reserve show a more dovish posture toward monetary policy, this would favor foreign equity market performance over the U.S. While this does not seem to be the direction the Fed is going, weaker economic momentum and benign inflation results could change that.

- An easing of trade tensions could make investors view foreign equities more favorably, since the markets have exhibited a belief that the U.S. tends to hold the stronger hand in trade negotiations.

- Finally, the positive impact of the fiscal stimulus provided by the Tax Cut and Jobs Act of 2017 is expected to dissipate after 2019. While some forecasters expect continued economic benefits from repatriated earnings and generous capital spending tax credits, these benefits may have less impact than expected or take a longer time to generate productivity gains. Should U.S. growth prove to be less than expected, this would remove a significant factor that has favored U.S. equity market dominance.

Our Viewpoint

On a strategic basis, we believe broad asset class diversification is a sound approach to investing, while tactical (shorter-term) positioning allows investors to adapt portfolios to current and expected conditions over a foreseeable time frame.

Taking the factors described above into account, we believe a tilt toward U.S. equity markets and away from foreign markets is the correct strategy. Momentum in the U.S. economy is strong and is likely to continue to attract capital from around the globe.

However, we do not believe a larger tactical move to fully exit foreign equity markets is wise. As we described above, there are several factors that could alter market dynamics in the months ahead, making continued participation in these markets a prudent investment strategy.

For a personal discussion of how today’s divergence and potential future factors may influence your individual portfolio decisions, please feel free to schedule a consultation with one of our investment managers.

* Source: Ed Clissold, CFA of Ned Davis Research, October 31, 2018

Investment and Insurance Products:

| NO BANK GUARANTEE | NOT A DEPOSIT | MAY LOSE VALUE | NOT FDIC INSURED |

| NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | |||

The information, views, opinions, and positions expressed by the author(s), presenter(s) and/or presented in the article are those of the author or individual who made the statement and do not necessarily reflect the policies, views, opinions, and positions of Hancock Whitney Bank. Hancock Whitney Bank makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information presented. This information is general in nature and is provided for educational purposes only. Information provided and statements made should not be relied on or interpreted as accounting, financial planning, investment, legal, or tax advice. Hancock Whitney Bank encourages you to consult a professional for advice applicable to your specific situation.