The latest encryption

All of our chip-enabled debit and credit cards encrypt your data so your actual account information is never visible or compromised.

PERSONAL BANKING

PERSONAL LOANS & CREDIT

RETIREMENT & INVESTMENTS

DIGITAL BANKING

BUSINESS BANKING

BUSINESS LOANS & CREDIT

BUSINESS SERVICES

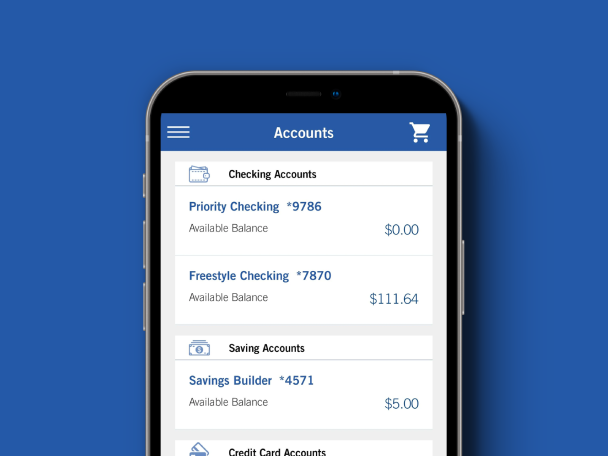

DIGITAL BANKING

COMMERCIAL BANKING

COMMERCIAL LOANS & FINANCING

TREASURY MANAGEMENT

ADDITIONAL COMMERCIAL SOLUTIONS

Explore Our Approach to Wealth

WHY HANCOCK WHITNEY

WEALTH MANAGEMENT

WEALTH PLANNING

INSTITUTIONAL

COMMUNITY INVOLVEMENT

COMPANY

OUR INSIGHTS BLOG

OUR TEAM

Insights Articles

Personal Banking

Small Business

Commercial Banking

Wealth

Company Insights

We use the latest security tools to protect your account and give you peace of mind that your financial information is always safe.

All of our chip-enabled debit and credit cards encrypt your data so your actual account information is never visible or compromised.

You can easily set up facial or fingerprint recognition on the Hancock Whitney mobile app and add an extra layer of security to your account.

We'll always ask to verify your identity when you log in with a device we don't recognize. That way, no one besides you can ever access your account.

We're vigilant about monitoring financial activity to safeguard your account. If we notice something suspicious, we'll send you a text or email.

Sign up for Visa® Purchase Alerts1 and you'll be alerted when your card is used to make a purchase over a specified amount or used outside of the U.S.

If you have the Visa® Platinum Credit Card from Hancock Whitney, the Visa Zero Liability Policy2 protects you from unauthorized purchases.

All of our chip-enabled debit and credit cards encrypt your data so your actual account information is never visible or compromised.

You can easily set up facial or fingerprint recognition on the Hancock Whitney mobile app and add an extra layer of security to your account.

We'll always ask to verify your identity when you log in with a device we don't recognize. That way, no one besides you can ever access your account.

We're vigilant about monitoring financial activity to safeguard your account. If we notice something suspicious, we'll send you a text or email.

Sign up for Visa® Purchase Alerts1 and you'll be alerted when your card is used to make a purchase over a specified amount or used outside of the U.S.

If you have the Visa® Platinum Credit Card from Hancock Whitney, the Visa Zero Liability Policy2 protects you from unauthorized purchases.

What should you do if you think you’ve become a victim of identity theft? Recovering from identity theft is a process and there are a number of steps you'll need to take to protect yourself from further damage.

If you can't find your Hancock Whitney debit or credit card, let us know and we'll prevent any charges from being made on your account. If your card reappears, we can always unlock it.

1Actual time to receive a transaction alert is dependent on wireless service and coverage within area. Message and data rates may apply. Some PIN-based debit transactions may be routed through non-Visa networks. Transactions routed through non-Visa networks will not trigger a purchase alert. For more information about Purchase Alerts, including any limitations and restrictions, go to www.hancockwhitney.com/purchase-alerts.

2Visa® Zero Liability Policy covers U.S.-issued cards only and does not apply to ATM transactions, PIN transactions not processed by Visa or certain commercial card transactions. You must notify your card issuer promptly of any unauthorized use. Consult your issuer for additional details or visit www.visa.com/security.