Send money to family members

Zelle® lets family members easily support one another financially. Parents, kids, grandparents, and siblings can all quickly send and receive money!

PERSONAL BANKING

PERSONAL LOANS & CREDIT

RETIREMENT & INVESTMENTS

DIGITAL BANKING

BUSINESS BANKING

BUSINESS LOANS & CREDIT

BUSINESS SERVICES

DIGITAL BANKING

COMMERCIAL BANKING

COMMERCIAL LOANS & FINANCING

TREASURY MANAGEMENT

ADDITIONAL COMMERCIAL SOLUTIONS

Explore Our Approach to Wealth

WHY HANCOCK WHITNEY

WEALTH MANAGEMENT

WEALTH PLANNING

INSTITUTIONAL

COMMUNITY INVOLVEMENT

COMPANY

OUR INSIGHTS BLOG

OUR TEAM

Insights Articles

Personal Banking

Small Business

Commercial Banking

Wealth

Company Insights

Zelle® lets you send and receive money with people you know by using an email address or US mobile number—as long as they have an eligible US bank account.1

Zelle® is a peer-to-peer (P2P) payment platform that allows you to quickly and securely send money to people you know and trust. It can be accessed through the Hancock Whitney mobile app.

To send and receive money, all you need is an email address or US mobile number that's associated with an eligible bank account. Transactions don't require both parties to use the same bank.

It's free to send and receive money with Zelle® from the Hancock Whitney mobile app.

Money goes directly into your account within minutes,1 so it’s there when you need it. There's no need to transfer the funds from third party accounts or digital wallets.

Share expenses, not account numbers. To send and receive money with Zelle®, all you need to share is an email address or US mobile number.

Enroll today and send money to friends and family. Already have the Hancock Whitney mobile app? You already have access.

Don't have the Hancock Whitney mobile app?

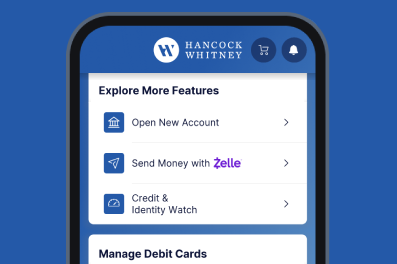

Log in to the Hancock Whitney app, scroll down, select Send Money with Zelle, and then select Send on the next screen.

Either follow the prompts to create a new contact or select a previous contact using an email address or US mobile number.

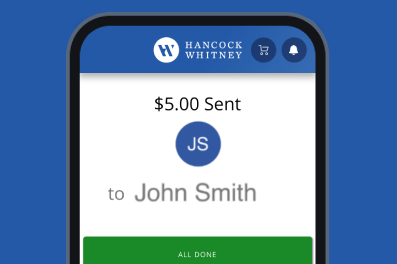

Next, enter the payment amount, select Review, and select Send at the next two prompts. Your funds have been sent!

Zelle® lets family members easily support one another financially. Parents, kids, grandparents, and siblings can all quickly send and receive money!

Babysitters, dogwalkers, housecleaners—Zelle® makes it easy to pay individuals for their services via your mobile device.

From birthdays to baby showers, sometimes money is the perfect gift. Use Zelle® to surprise your loved one with a financial gift at just the right moment.

Splitting expenses with roommates has never been easier. From the power bill to the rent, easily pool money for the monthly billpaying session.

You can now support your community and use Zelle® to make purchases from participating small businesses!

Friends can use Zelle® to borrow and repay money almost instantly, without the need to use cash or exchange account numbers.

Zelle® lets family members easily support one another financially. Parents, kids, grandparents, and siblings can all quickly send and receive money!

Babysitters, dogwalkers, housecleaners—Zelle® makes it easy to pay individuals for their services via your mobile device.

From birthdays to baby showers, sometimes money is the perfect gift. Use Zelle® to surprise your loved one with a financial gift at just the right moment.

Splitting expenses with roommates has never been easier. From the power bill to the rent, easily pool money for the monthly billpaying session.

You can now support your community and use Zelle® to make purchases from participating small businesses!

Friends can use Zelle® to borrow and repay money almost instantly, without the need to use cash or exchange account numbers.

Treat Zelle® the same as cash. Only use Zelle® with people you know and trust. Once a payment is authorized, it often isn't possible to cancel or reverse.

Always confirm recipient contact info before sending money. Consider first sending a small test transaction if it's your first time using Zelle® with that person.

Zelle® isn't intended for making purchases on online marketplaces. There are no purchase protections, and payment scams are common on these platforms.

Keeping your money and information secure is a top priority for Hancock Whitney. When you use Zelle® within our mobile app, your information is protected with the same technology we use to keep your Hancock Whitney account secure.

You can send, request, or receive money with Zelle®. To get started, log into Hancock Whitney mobile app and select Send Money with Zelle®. Accept the Terms and Conditions, enter your email address or U.S. mobile number, receive a one-time verification code, enter it, review, and you’re ready to start sending and receiving with Zelle®.

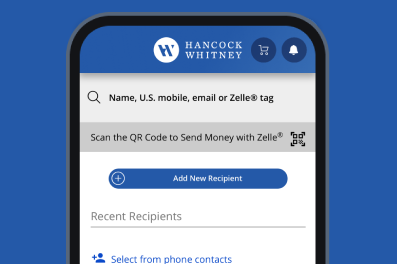

To send money using Zelle®, simply select someone from your mobile device’s contacts (or add a trusted recipient’s email address or U.S. mobile number), add the amount you’d like to send and an optional note, review, then hit “Send.” The recipient will receive an email or text message notification via the method they used to enroll with Zelle®. Money is available to your recipient in minutes if they are already enrolled with Zelle®.

To request money using Zelle®, choose “Request,” select the individual from whom you’d like to request money, enter the amount you’d like, include an optional note, review and hit “Request”. If the person you are requesting money from is not yet enrolled with Zelle®, you must use their email address to request money. If the person has enrolled their U.S. mobile number, then you can send the request using their mobile number.

To receive money, just share your enrolled email address or U.S. mobile number with a friend and ask them to send you money with Zelle®. If you have already enrolled with Zelle®, you do not need to take any further action. The money will be sent directly into your Hancock Whitney account, typically within minutes.

If someone sent you money with Zelle® and you have not yet enrolled with Zelle®, follow these steps:

Your email address or U.S. mobile number may already be enrolled with Zelle® at another bank or credit union. Call our customer support team and ask them to move your email address or U.S. mobile number to Hancock Whitney so you can use it for Zelle®.

Once customer support moves your email address or U.S. mobile number, it will be connected to your Hancock Whitney account so you can start sending and receiving money with Zelle® through the Hancock Whitney mobile app. Please call Hancock Whitney customer support toll-free at 1-800-448-8812 for help.

Neither Hancock Whitney nor Zelle® offers purchase protection for payments made with Zelle® – for example, if you do not receive the item you paid for, or the item is not as described or as you expected. Only send money to people and small businesses you trust and always ensure you’ve used the correct email address or US mobile number when sending money.

Please contact our customer support team at 1-800-448-8812. Qualifying imposter scams may be eligible for reimbursement.

Zelle® is a great way to send money to family, friends, and people you are familiar with such as your personal trainer, babysitter or neighbor1.

Since money is sent directly from your Hancock Whitney account to another person’s bank account within minutes1, Zelle® should only be used to send money to friends, family and others you know and trust.

If you don’t know the person or aren’t sure you will get what you paid for (for example, items bought from a sales site or fake job offers), you should not use Zelle®. These transactions are potentially high risk (just like sending cash to a person you don’t know is high risk).

Neither Hancock Whitney nor Zelle® offers a protection program for any authorized payments made with Zelle® – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

Remember, although Hancock Whitney may call you for verification purposes or send product or promotional offerings via email, we will NEVER contact you and direct you to send money via Zelle®. We will also NEVER ask for your Social Security Number, Personal Identification Number or online banking login credentials.

In order to use Zelle®, the sender and recipient’s bank or credit union accounts must be based in the US.

No, Zelle® payments cannot be reversed.

You can only cancel a payment if the person you sent money to hasn’t yet enrolled with Zelle®. To check whether the payment is still pending because the recipient hasn’t yet enrolled, you can go to your activity page, choose the payment you want to cancel, and then select “Cancel This Payment.” If you do not see this option available, please contact our customer support team at 1-800-448-8812 for assistance with canceling the pending payment.

If the person you sent money to has already enrolled with Zelle® through their bank or credit union's mobile app or online banking, the money is sent directly to their bank account and cannot be canceled. This is why it’s important to only send money to people you trust, and always ensure you’ve used the correct email address or U.S. mobile number when sending money.

If you sent money to the wrong person, please immediately call our customer support team at 1-800-448-8812 to determine what options are available.

No, Hancock Whitney does not charge any fees to use Zelle® in the Hancock Whitney mobile app. Your mobile carrier’s messaging and data rates may apply.

The amount of money you can send, as well as the frequency, is set by each participating financial institution. To determine Hancock Whitney send limits, call our customer service at 1-800-448-8812.

There are no limits to the amount of money you can receive with Zelle®. However, remember that the person sending you money will most likely have limits set by their own financial institution on the amount of money they can send you.

You can find a full list of participating banks and credit unions live with Zelle® here.

If your recipient’s bank or credit union isn’t on the list, don’t worry! The list of participating financial institutions is always growing.

Zelle® QR code provides peace of mind knowing you can send and receive money to the right person, without typing an email address or US mobile number.

To locate your Zelle® QR code, log into the Hancock Whitney mobile app, click Send Money with Zelle®. Next, go to your “Zelle® settings” and click Zelle® QR code and your QR code will be displayed under “My Code.” From here you can view your QR code and use the print or share icons to text, email or print your Zelle® QR code. To receive money, share your Zelle® QR code.

To send money, log into the Hancock Whitney mobile app, click Send money with Zelle®, click Send, then click on the QR code icon displayed at the top of the “Select Recipient” screen. Once you allow access to your camera, simply point your camera at the recipient’s Zelle® QR code, enter the amount, hit Send, and the money is on the way! When sending money to someone new, it’s always important to confirm the recipient is correct by reviewing the displayed name before sending money.

When you send money with Zelle®, it's typically just a matter of minutes1 before the funds are available to use in the recipient's account.

While nothing stops you from using Zelle® with strangers, you do so at your own risk. There are no payment protections, and transactions typically can't be reversed or canceled.

It's always best to treat Zelle® like cash and only use it to send money to people you know and trust.

Payments made using Zelle® go directly from one bank account to another. This means that the funds are never stored in a third-party app account or "wallet."

As your bank account is FDIC-insured, the funds from a Zelle® payment are FDIC-insured as they are immediately deposited into your bank account.

1 Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

To send or receive money with Zelle®, both parties must have an eligible checking or savings account. Transactions between enrolled users typically occur in minutes. Only send money to people you know well and trust. If you don’t know the person you are paying or are unsure you will receive what you are purchasing, then we don’t recommend you use Zelle® for the transaction. Please be aware that neither Hancock Whitney nor Zelle® offers purchase protection for payments made with Zelle®. This means that if you don’t receive the item you paid for, or if it’s not as described, you may not be able to recover your funds.

Apple is a trademark of Apple Inc., registered in the U.S. and other countries. Apple Pay is a trademark of Apple Inc.

Android and Google Play are trademarks of Google Inc., registered in the U.S. and other countries.