1 $500 Business Checking Bonus Requirements: Use the required promo code provided when opening a new Preferred Business Checking, Interest Business Checking, or Essential Business Checking account with new money not currently held by Hancock Whitney Bank before the offer expiration of 7/31/2026. To meet requirements, you must enroll in online banking and make at least $5,000 in qualifying deposits within the first 30 days from opening your business checking account. You must continue to maintain the $5,000 or more balance for the next 60 days to receive the payout. If you meet the 90-day Requirements the Offer Payout will be deposited into your Business Checking Account within 45 days.

This offer is available to new-to-bank or existing Hancock Whitney checking clients who currently do not have a business or commercial checking account; have not closed a business or commercial checking account in the past 90 days; or did not have a checking account closed with a negative balance in the past three (3) years. There is a $50 minimum deposit to open account. A $20 fee applies if account is closed within 360 days of opening account.

2 Up to $750 Payment Processing Bonus: To receive the Payment Processing Promotional Offer you must both apply and be approved for a new Merchant Services payment processing account and open a new business checking account1 before the offer expires on 7/31/2026. The following criteria will be used to determine your Payment Processing Promotional Payout amount:

-

To qualify for the $250 Payment Processing offer, you must (1) apply and be approved for a new Merchant Services payment processing account and, (2) activate the account by processing a minimum of $20 in total payment volume no later than the end of the second full calendar month after credit approval. If you meet all requirements within the two full month period, your $250 Bonus will be deposited into your eligible Hancock Whitney Business Checking account 30 days after the end of the two full month period during which the requirements were met. Example: If your account is approved on January 10, you must process at least $20 by March 31. Your $250 bonus will then be deposited within 30 days of March 31.

-

To qualify for the $500 Payment Processing offer, you must (1) apply and be approved for a new Merchant Services payment processing account and, (2) process between $5,000 and $7,499 in total payment volume no later than the end of the second full calendar month after credit approval. If you meet all requirements within the two full month period, your $500 Bonus will be deposited into your eligible Hancock Whitney Business Checking account 30 days after the end of the two full month period during which the requirements were met. Example: If your account is approved on January 10, you must process at least $5,000 by March 31. Your $500 bonus will then be deposited within 30 days of March 31.

-

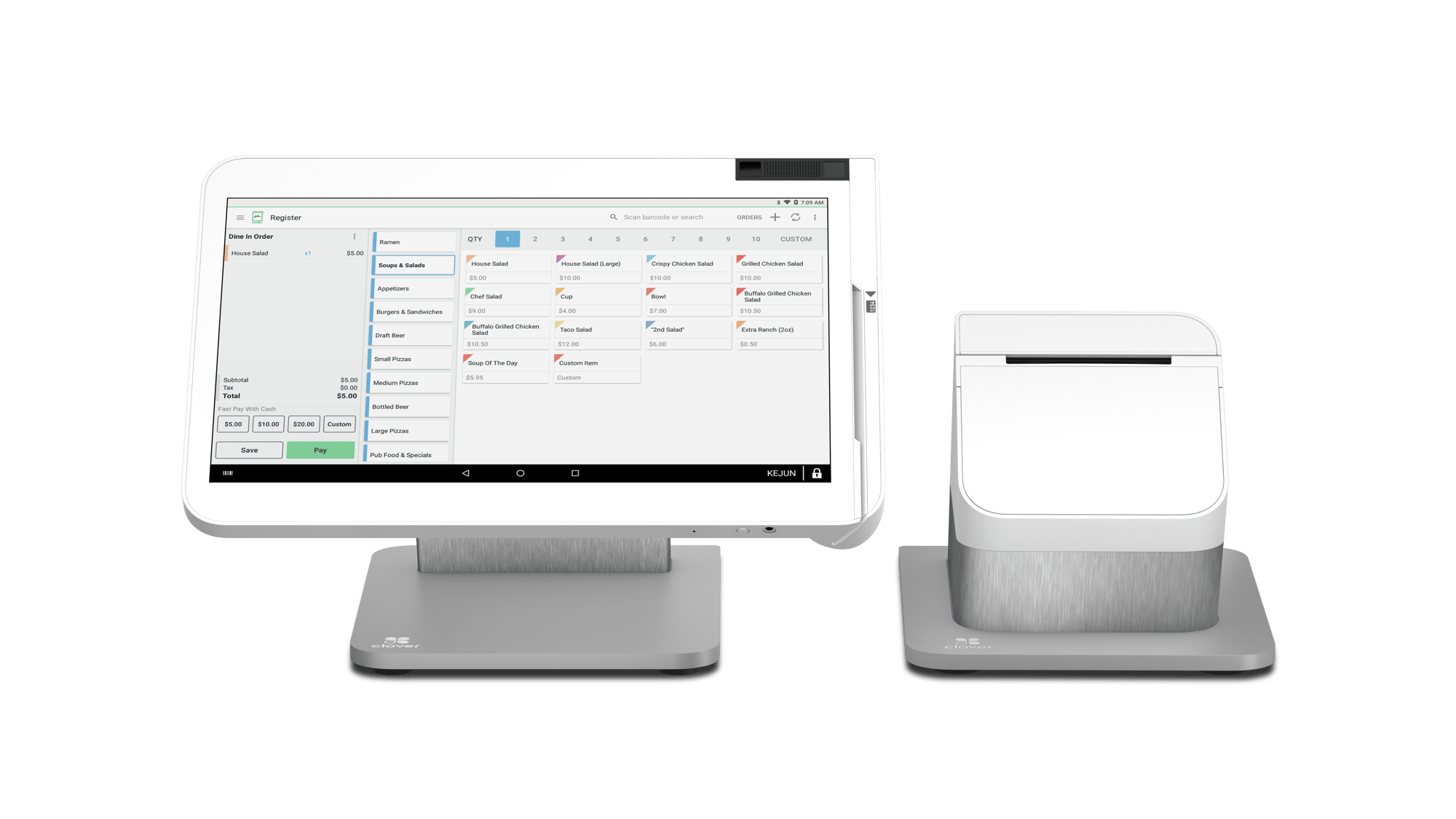

To qualify for the $750 Payment Processing offer, you must (1) apply and be approved for a new Merchant Services payment processing account that operates on the Clover platform and, (2) process $7,500 or more in total payment volume no later than the end of the second full calendar month after credit approval, and (3) enroll in Melio Pay Bills and/or Clover Payroll by ADP via the Clover Dashboard after your Merchant Services account has been approved and Clover account activated. If you meet all requirements within the two full month period, your $750 Bonus will be deposited into your eligible Hancock Whitney Business Checking account 30 days after the end of the two full month period during which the requirements were met. Example: If your account is approved on January 10, you must process at least $7,500 by March 31. Your $750 bonus will then be deposited within 30 days of March 31.

The Merchant Services payment processing account must remain open and active until the bonus is paid after account activation. Merchant Services Early Termination Fee and Monthly Minimum Fee applies. The bonus will be deposited into your linked Hancock Business Checking account.

A new or existing Hancock Whitney Business Checking account is required for this offer and must be used to settle funds through the merchant services processing activities. The business checking account must remain open and active until the bonus is paid.

Based on the requirements you meet as defined above for the Merchant Services Payment Processing Bonus, your bonus will be posted to your Business Checking account.

Clover trademark and logo are owned by Clover Network, Inc., a First Data company.

Melio Pay Bills™ is a service provided by Melio Payments Inc. (“Melio”). Hancock Whitney Bank is not affiliated with Melio and does not provide, control, or guarantee Melio services. Enrollment in Melio Pay Bills™ is subject to Melio’s separate terms, conditions, and fees. Additional eligibility requirements may apply.

Clover Payroll by ADP® is a service provided by Automatic Data Processing, Inc. (“ADP”). Hancock Whitney Bank is not affiliated with ADP and does not provide, control, or guarantee ADP payroll services. Enrollment in Clover Payroll by ADP® is subject to ADP’s separate terms, conditions, and fees. Additional eligibility requirements may apply.

All loans and accounts are subject to credit approval. Terms and conditions apply.

Hancock Whitney Bank, Member FDIC.

Hancock Whitney Bank is a contracted reseller of the Clover® Solution. This Web page or website is not an official page of Clover® Network Inc., First Data Corporation, its subsidiaries or affiliated businesses. The Clover® trademark and logo are owned by Clover® Network, Inc., a First Data company.

.png?width=2000&name=clover-go-and-phone-composite-01%20(1).png)