- Personal

-

Personal Banking Services

PERSONAL BANKING

PERSONAL LOANS & CREDIT

RETIREMENT & INVESTMENTS

DIGITAL BANKING

- Business

-

Business Banking Services

BUSINESS BANKING

BUSINESS LOANS & CREDIT

BUSINESS SERVICES

DIGITAL BANKING

- Commercial

-

Commercial Banking Services

COMMERCIAL BANKING

COMMERCIAL LOANS & FINANCING

TREASURY MANAGEMENT

ADDITIONAL COMMERCIAL SOLUTIONS

- Wealth

WHY HANCOCK WHITNEY

WEALTH MANAGEMENT

WEALTH PLANNING

- Financial and Retirement Planning

- Legacy and Estate Planning

- Generational Wealth Transfer

- Business Exit Planning

×You’re leaving HancockWhitney.com to visit Hancock Whitney Financial Consultants.

Hancock Whitney provides links to other websites for your convenience and does not control the content, services, or products provided on the linked website, whose Privacy and security policies or procedures may differ. Consult the policies or disclosures on their website.

HWFC investment and Insurance products: *Not FDIC insured *May lose value *Not financial institution guaranteed *Not a deposit *Not insured by any federal government agency

INSTITUTIONAL

Explore Our Approach to Wealth

- About Us

COMMUNITY INVOLVEMENT

COMPANY

OUR INSIGHTS BLOG

OUR TEAM

- Search

Earn a $200 bonus.

New checking clients get $200 after opening a Freestyle Checking account and meeting requirements†.

How can we help?

WHAT'S YOUR GOAL?

I want to

Freestyle Checking

Get the convenience and flexibility you need from a personal checking account.

-

Never worry about NSF fees

-

Service charge waived with one qualifying monthly transaction

-

Account protection with Visa® Purchase Alerts2

Mortgage solutions

Get flexible terms, competitive rates, and the support of a local home lending expert who can match you with the right mortgage.

-

Loans for more established buyers

-

Government-backed loans for new borrowers

-

Loans for active duty military and veterans

100+ years of turning dreams into businesses

We offer a full suite of business solutions designed to get your business started and help it grow.

-

Business loans and lines with flexible terms

-

Checking accounts with great service and powerful tools at your fingertips

-

Merchant Services solutions to streamline your retail payments

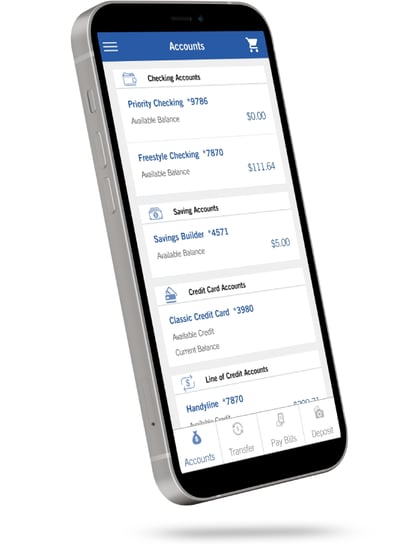

Bank where you want, when you want

Get the convenience of banking on the go or at home, with digital tools that put your account at your fingertips.

Pay your bills in one place with Bill Pay

Why your neighbors trust Hancock Whitney

For more than a century, Hancock Whitney has been dedicated to the financial well-being of Gulf South communities.

For the third consecutive year we’ve been named one of America’s Best Banks by Forbes.

We give back to our local communities because we're committed to the future of our region.

Want to explore other ways to reach your financial goals?

✝Important details and required qualifying activities for the $200 Freestyle Checking offer: Offer available to new Hancock Whitney checking clients. This includes new to bank clients and existing Hancock Whitney clients who currently do not have a checking account, or have not recently closed a checking account in the past 90 days, or did not have a checking account closed with a negative balance in the past 3 years.

Promotion requirements for the Freestyle Checking offer: The email given at account opening must match the email address submitted to get the offer promo code and the promo code is required to be included in the account opening. All account applications are subject to approval.

A qualifying direct deposit is a recurring electronic deposit, including a salary, pension, Social Security, other government benefit or other recurring, monthly income amount, made by your employer or outside agency. Account transfers, mobile deposits, payments from Zelle®, PayPal, Cash App or other similar providers, tax refunds or deposit made at a branch or ATM are not qualifying direct deposits.

The Bank may change or discontinue the offer at any time and without notice. This offer is non-transferable and cannot be combined with other offers. Only the person to whom this offer is addressed is eligible for this offer. Limit of one consumer checking-related bonus per household every 2 calendar years. Bonuses may be considered interest and may be reported on IRS Form 1099.

Freestyle Checking Account Terms and Conditions: $25 minimum opening deposit is required. Monthly service charge of $10 can be waived by the following: primary account holder under 18 or age 64 and over with valid date of birth on file, or is an eligible Priority Checking or Private Wealth Management Client, or make one or more client-initiated debit and/or credit transactions per statement cycle to waive the service charge. If your account is closed within the first 180 days after opening, a $20 service charge will be assessed and we reserve the right to deduct the bonus amount from your account’s closing balance if applicable. Please refer to the Truth in Savings Disclosure for other applicable fees and information.

1. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. Only send money to people you know well and trust. If you don't know the person you are paying or are unsure you will receive what you are purchasing, then we don't recommend you use Zelle® for the transaction. Once you have authorized and made a payment through Zelle®, it may not be possible to reverse the payment or recover the funds.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

2. NSF items created by check, in-person withdrawals or other electronic means that overdraw (OD) an account may be charged $36.00 per item. If you have opted into the payment of ATM and everyday debit card (POS) transactions into OD, we may assess OD fees on those items as well. We waive OD fees on the following: NSF items of $5 or less or overdrawn balances of $10 or less at the end of nightly batch processing. See our Truth in Savings Disclosure and Deposit Agreement for more information. We pay overdrafts at our discretion and do not guarantee that we will always authorize payment of any transaction. For example, we typically do not pay overdrafts if your account is not in good standing. If your account is overdrawn, you must immediately bring it to a positive balance. Visit a financial center or www.hancockwhitney.com/overdraft-protection-services for additional details on the Bank’s OD practices.

3. All account applications are subject to approval. $25 minimum opening deposit is required. Monthly service fee of $10 can be waived by the following: primary account holder under 18 or age 64 and over or make one or more client-initiated debit or credit transactions per statement cycle to waive the service charge. No minimum daily balance or minimum direct deposit amount is required to waive the service charge. If your account is closed within the first 180 days after opening, a $20 service charge will be assessed and we reserve the right to deduct the bonus amount from your account’s closing balance. Please refer to the Truth in Savings Disclosure for other applicable fees and information.

PROUD TO BE AN OFFICIAL SPONSOR OF

Hancock Whitney Bank, Member FDIC and ![]() Equal Housing Lender. All loans and accounts subject to credit approval. Terms and conditions apply.

Equal Housing Lender. All loans and accounts subject to credit approval. Terms and conditions apply.

Hancock Whitney and the Hancock Whitney logo are federally-registered trademarks of Hancock Whitney Corporation. © Hancock Whitney 2025

![]()