Understanding Your Credit Score - Is 700 a Good Credit Score?

What is the average credit score? Is 700 a Good Credit Score? Understand how your credit score is determined, and ways to improve your score.

2 min read

Hancock Whitney

March 22, 2023 |

Your credit score can have a big impact on your financial life, and understanding how credit scores work can help you achieve financial goals such as paying off debt or buying a home. While it may be easy to find out what your credit score is, do you know how a credit score is determined?

Anatomy of a Credit Score

Your credit score is a snapshot of your creditworthiness at a given point in time. Used by mortgage lenders, car loan lenders, credit card companies, landlords, and cell phone companies, your score is the key to your financial life.

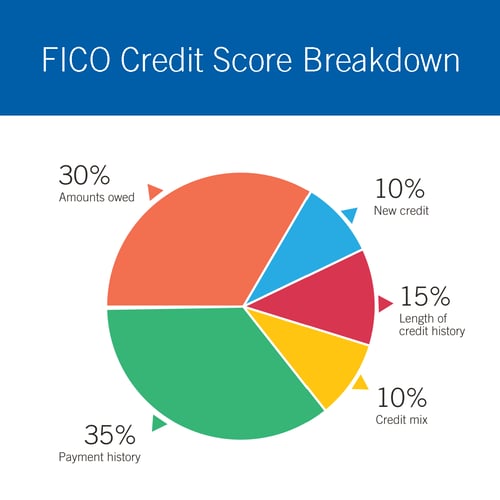

Also known as a FICO® score, your credit score is based on information from your credit report and calculated according to your rating in five general categories:

The Credit Bureaus

A person’s credit performance is generally thought to be an indication of his or her future behavior. The three credit reporting agencies – Experian, Equifax, and TransUnion – collect information from creditors, lenders, utilities, debt collection agencies and the courts (such as bankruptcy) that a consumer has had a relationship with. This information is aggregated into the consumer reporting agency’s data files, and made available on request for the purposes of assessing credit risk, credit scoring, employment consideration, or leasing an apartment.

Credit scores can vary among the three reporting agencies, and not all financial institutions use the same credit bureau data. That’s why it’s important for you to regularly monitor your credit score and credit history. Federal law requires the credit bureaus to provide a free credit report to consumers once a year; www.annualcreditreport.com is the only web site authorized to give free annual credit reports from all three credit bureaus to consumers.

Checking the reports from all three credit bureaus should be a priority on your financial to-do list, and we make it easy with the identity protection and credit monitoring services that are included with our Assure Checking Account and Priority Checking Account.

What Is The Average Credit Score?

The national average FICO is 714 out of a possible 8501. The riskiest consumers have scores below 600, and higher scores are better and generally translate to lower interest rates.

Tips to Improve Your Credit Score

There are actions you can take if you want to improve your credit score:

1. Develop healthy repayment habits:

Pay your bills on time.

Get current with missed payments.

Understand that paying off a delinquent loan won't remove it from your report.

Contact your creditors or a credit counselor if you're having trouble.

2. Manage your debt:

Keep balances low.

Pay off debt rather then moving it around.

Don't close unused credit cards.

Don't open unneeded credit accounts.

3. Be smart about credit:

Check your credit report.

Don’t open new accounts one after the other if you’re new to credit.

Apply for and open only necessary accounts.

Use credit cards – but manage them responsibly.

Remember that closing an account doesn’t make it go away.

Credit is a powerful and useful tool, and it’s a financial necessity in today’s fast-paced world. Learn more about credit scores by visiting our financial education platform Financial Cents.

Our bankers are ready to guide you in starting and building a good credit history, and can also give you advice and options to help improve your credit score and get out of debt faster.

This information is for educational and illustrative purposes only.

Sources

1. Horymski, C. (2023, February 24). What is the average credit score in the U.S.? Experian. Retrieved March 1, 2023, from https://www.experian.com/blogs/ask-experian/what-is-the-average-credit-score-in-the-u-s/#:~:text=The%20average%20FICO%20Score%20in,years%20of%20average%20score%20increases.

Explore more Insights

Get financial insights delivered to your inbox

Sign up to receive regular updates from our team of experts.