Quickly access your money with Direct Deposit.

Once set up, direct deposit swiftly and conveniently puts your money in your account with no additional action required.

What is direct deposit?

Direct deposit is an electronic funds transfer where the money is securely deposited directly into your checking or savings account without the need for physical checks.

With direct deposit, you can enjoy the convenience of knowing your money is in your account on time and without the need to visit a physical location or make a mobile deposit.

Paychecks

Retirement income

Social Security benefits

How to set up direct deposit using our mobile app

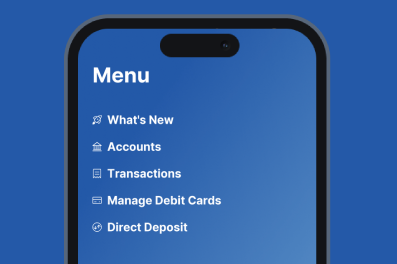

In the mobile app, tap Direct Deposit in the main menu. Once you’re ready to switch your direct deposit, select Get Started.

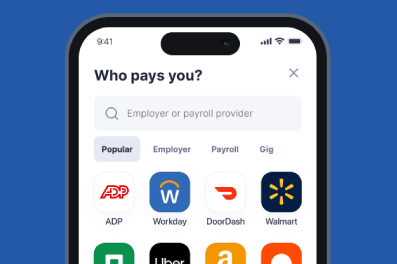

Select the account you want to use. On the next screen, choose your payroll provider and employer, then log in using your work credentials. Review and verify your selections.

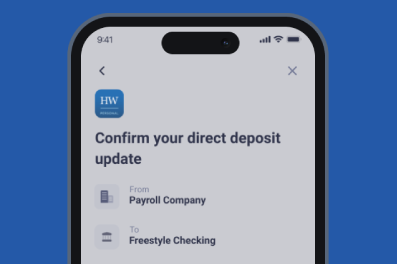

Determine if you want a portion of your paycheck or the entire paycheck deposited into your account. Once your details are set, tap Confirm. Your direct deposit is confirmed.

View Demo

If your employer is not eligible for electronic enrollment in direct deposit, use the form provided to set up direct deposit.

If you need help setting up direct deposit with your Social Security benefits, please visit the page on their website and follow the prompts.

Get paid up to 2 days sooner with Early Pay1

When you set up direct deposit using your Hancock Whitney checking or savings account, you will automatically get your money up to two days before the scheduled payment date. No fees, no need to sign up.

Make sure you've got the new mobile app

You can seamlessly enroll in direct deposit from the new mobile app — but you have to download it first! Our new mobile app is packed with even more powerful financial tools that are designed to give you more control over your finances.

1 Early Pay grants access to eligible direct deposit payments (PPD ACH transactions $25,000 and under) made into a Hancock Whitney Checking or Savings account up to two days prior to the scheduled payment date.

Certain payroll payments may not be eligible for Early Pay. Early Pay availability is based on the timing of the payor’s payment instructions and therefore, you may not always see your direct deposits arrive early. Hancock Whitney does not guarantee early availability of these direct deposits. Early Pay eligibility may vary between pay periods, and daily/transaction limits apply. Any direct deposit not posted early will be made available to you in accordance with the payment instructions. After we have made the deposit available to you and you have withdrawn funds, you remain responsible if any deposit to your account is returned, rejected or uncollected by Hancock Whitney.

No action is needed to take advantage of Early Pay. Early Pay will be activated for all Hancock Whitney Checking and Savings accounts only.